Being forced to “stay home” during lockdown has been pretty good for our bank balances.

Since the beginning of the pandemic, according to the Financial Times, consumers around the world have amassed an extra $5.4 trillion in savings. And in the UK, Fidelity International found that, on average, Brits are around £1,744 better off.

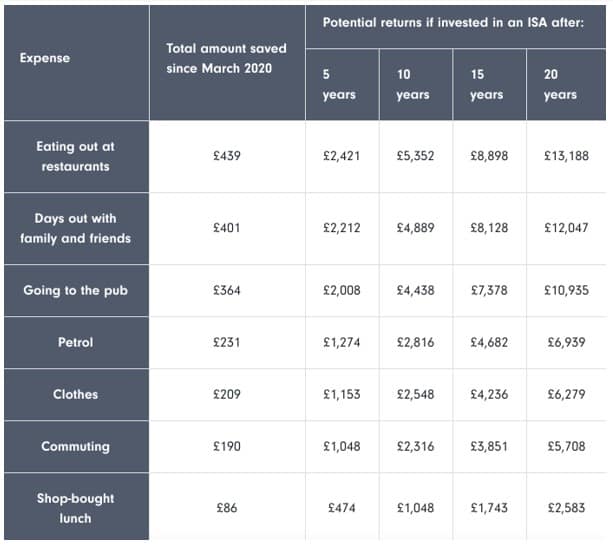

The research also revealed an interesting breakdown of where we’ve made savings.

65% of UK adults spent less between March 2020 and March 2021.

On average we have saved:

- £439 on eating out at restaurants

- £401 on days out with family and friends

- £364 on going to the pub

- £190 on the daily commute

- £86 on lunchtime salads and sarnies.

So, what are you planning to do with your lockdown savings?

Here are four wise ways to use your lockdown savings.

1. Pay off debt or pay down your mortgage

Paying off debt is one of the first things you should do, especially if you have credit card debt. Credit and store cards can have high interest rates, so it’s always best to pay them off as soon as you can.

If you’re on top of your credit card payments, you could use your extra cash to pay down some of your outstanding mortgage.

If your mortgage provider allows overpayments without penalty, take advantage of using your lockdown savings to cut the amount you owe. Not only will you reduce the outstanding debt, but you’ll also save on interest costs in the immediate and longer-term.

2. Top up your pension

Is retirement still a way off? If so, consider paying your lockdown savings into your pension. If you want to make an additional payment to your pension, the government will top contributions up through tax relief.

The level of tax relief you receive will depend on your income tax bracket and applies to pension contributions up to 100% of your salary or £40,000, whichever is lowest.

3. Invest in an ISA

It’s still pretty early in the new tax year, so if you haven’t already used your ISA allowance (£20,000 a year for UK adults) consider investing in an ISA and start benefiting from the wonders of compound interest while your money grows tax-free.

ISAs can be useful investments to hold alongside your pension savings, since any income you receive will also be free from Income or Capital Gains Tax.

A simple no-brainer.

The table below shows a hypothetical illustration assuming a 5% growth rate each year, and fees of 1.10%. The sum invested is based on how much money an average consumer has saved by being unable to do everyday things.

Source: Fidelity International, March 2021

4. Save for the children in your life

Whether you still have young children at home or you’re enjoying grandparenthood, investing for children while they’re young is one of the best gifts you can give.

The biggest advantage with investing for children is that the money you save is likely to be invested for several years. And compound interest on investments means the earlier you invest the better.

Whatever the money is used for in the future, taking full advantage of the wondrous powers of compound interest will put the children in your life in a powerful position in early adulthood.

Two good ways to invest for children:

- Junior ISA (JISA) – parents or guardians must open a JISA. The child can access the money when they turn 18. Any money put into a JISA is free of tax, and you can invest up to £9,000 (2021/22) each year.If, at 18, they don’t want to withdraw the funds, the account will transfer to an adult ISA, and the money will remain invested.

- Pay into a child’s pension – The idea of paying into a pension for a child still in nappies may seem absurd, but the potential gains can make it a compelling idea. A parent or guardian must open the pension for their child, but once set up any family member can invest.

Free from Income Tax and Capital Gains Tax, you can invest £2,880 tax-efficiently each year. The government automatically tops up contributions by 20%. So, if you made an annual payment of £2,880, it would automatically become £3,600.

If you would like to have a conversation about how you can make the most of your lockdown savings, please get in touch. Email us at info@kbafinancial.com or call us on 01942 889883.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

Levels and bases of, and relief from, taxation are subject to change.