If retirement is a milestone that you’re looking forward to in 2024, a little pre-thought and preparation now could help ensure a smooth transition to the next chapter of your life.

You may have mixed emotions about your imminent retirement. There may be some nervous niggles at the back of your mind, or you may be itching to embrace the change and throw yourself into a life of freedom.

Whatever the case for you, here are five financial tasks to act on before you step away from work.

1. Tally your lifestyle goals and retirement income

With retirement approaching, you’ve almost certainly been dreaming about all the ways you’re looking forward to spending your free time.

You may have immediate travel plans in the offing for the weeks or months following your retirement but how will you spend your normal everyday time at home?

Having a firm understanding about how you intend to spend your time in retirement will help you work out how much income you’ll need to support your lifestyle when you’re no longer working.

For example, if your plan is to spend more time with your grandchildren, enjoy tending to your garden, or throwing yourself into a new hobby at home, you’ll likely require less income than if you’re planning on enjoying a cruise every quarter.

2. Work out your retirement budget

Once you know how much your desired lifestyle is likely to cost, you’re ready to create a realistic retirement budget.

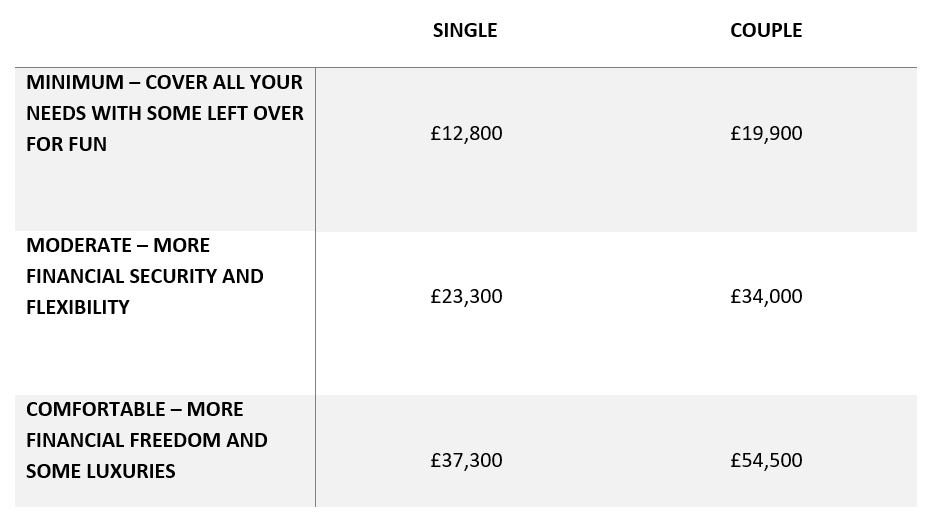

As a guide, the Retirement Living Standards organisation suggests that a couple wishing to cover all their needs, with enough left over for to spend on fun, would need post-tax income of around £19,900 a year. A couple with ambitions for a more comfortable and luxurious lifestyle would need around £54,500. [Source A].

The table below provides a helpful at-a-glance measure, breaking things down for couples and singles. If you were relocating to London in retirement, these figures would rise to meet the higher cost of living in the capital.

Source: Pensions and Lifetime Savings Association

Knowing your how much income you’ll need to generate from your pension, savings and investments now can help plan ahead and organise your finances before you finish work.

If you have big plans for your first few years of retirement, you may need to factor this into your plan. For example, you may want to take a round-the-world trip, buy a new car, or make substantial changes to your home.

Factoring this into your calculations before you retire can help to give you peace of mind that you have the funds to help meet all your retirement costs – in both the short and long term.

3. Review your pension and other assets

While your mind may immediately leap to your pension when planning your retirement income, it might not be the best place to start.

When stock markets are volatile, selling at the wrong time could leave you with less to spend than you had hoped. By using extra cash savings first, you can leave your pension savings invested, which could provide enough time for funds to recover any lost value.

Plus, because pension funds benefit from tax-free growth, interest, and dividends, leaving your pension savings invested is especially useful for maintaining capital value.

Another consideration that might play into your decision is that pension funds are usually not subject to IHT. As a result, leaving your pension fund intact while drawing on other investments may help to reduce your IHT liability.

While pensions are often the centre of retirement plans, you might want to use other assets too. From saving accounts to second properties, understanding how other assets could be turned into an income stream could help you fund your retirement dreams.

A financial planner will be able to assess all of your assets and help you devise a tax-efficient strategy for providing a sustainable retirement income.

4. Check your State Pension and track down any lost pensions

The State Pension often forms the foundation for your retirement planning, and could provide a reliable income for you to build on.

When you can claim the State Pension and how much you’ll receive will depend on your age and the number of qualifying years you have on your National insurance record.

Use the government’s State Pension forecast tool to understand what you could expect.

Plus, if you’ve changed employers during your career, you may have lost track of past pension arrangements. And now is the time to think about whether this may be the case for you.

Pension providers should send regular correspondence and an annual statement summarising how much is in your account and what income you could receive in retirement.

If you think you may have a pension where this is not the case and know who the pension provider is, contact them to ask for details of what is in your account. If you have moved house or are no longer receiving correspondence, contact your old employer and ask them for details of the pension provider.

Should you draw a blank with the above steps, try the Pension Tracing Service on the government website.

5. Meet with your financial planner

As you may have gathered, retirement planning can be complex. There are a lot of factors you’ll need to take into account.

A financial planner can help you create a strategy to deliver a suitable and sustainable retirement income using all your available assets in the most tax-efficient way.

Arranging a meeting with a financial planner could help you create a retirement plan. A little foresight and planning now could bring you peace of mind that you’re financially ready for your upcoming retirement.

Get in touch

If you’d like help in preparing your finances for the next chapter of your life, please get in touch. Email contactme@kbafinancial.com or call us on 01942 889 883.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

HM Revenue and Customs’ practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

Workplace pensions are regulated by The Pension Regulator.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Approved by The Openwork Partnership on [18/12/2023].