Anne Robinson has recently been in the news, sharing how she has already taken steps to ensure her family avoid a hefty Inheritance Tax (IHT) bill on her £50 million fortune.

In a report from the Independent, she said: “I’ve given it all away. I don’t want the taxman to have it […] I’ve spread it about quite a lot, to the children. They may as well enjoy it now.”

According to government data reported by the Times Money Mentor, in the 2023/24 tax year, HMRC collected a record £7.5 billion in IHT. And, in 2024/25, it’s expected that IHT receipts will surpass last year’s record sum.

As Anne Robinson has shown, being able to pass on your wealth to your loved ones is an important part of financial planning for many families, but it can be challenging area to navigate.

So, read on to find out how IHT works and discover five practical steps you could take to protect your legacy.

How Inheritance Tax is calculated and two nil-rate bands you can use

The standard rate of IHT is 40% of your money and applies to assets above a tax-free threshold called the “nil-rate band”. In the 2024/25 tax year, the nil-rate band is £325,000.

You may also benefit from an additional residence nil-rate band of £175,000, if you pass your main residence to your direct descendants, such as your children or grandchildren.

Together, these thresholds allow you to pass up to £500,000 to beneficiaries tax-free.

If you’re married or in a civil partnership, you could pass on any unused nil-rate band or resident nil-rate band to your spouse on your death. So, as a couple, you could pass on up to £1 million without incurring any IHT.

However, if your total estate is worth £2 million or more, your residence nil-rate band will be tapered by £1 for every £2 over that threshold. That means, should your estate be worth more than £2.35 million, your residence nil-rate band could taper away to nothing.

Any value in your estate above these amounts will be subject to a 40% tax charge, which can eat into your children or grandchildren’s inheritance.

As such, it could be wise to consider strategies that mitigate IHT, potentially reducing your tax bill and ensuring that your family receive as much of your wealth as possible.

5 estate planning strategies that may help you avoid being caught out by Inheritance Tax

1. Give gifts to your loved ones

Gifting money or assets to reduce the size of your estate is one of the favoured ways to avoid paying IHT in the UK, and the strategy already deployed by Anne Robinson.

You have an annual tax-free gifting exemption, allowing you to give money away without it being included in the value of your estate. In 2024/25, the annual exemption is £3,000. Plus, you can carry forward one years’ worth of any unused gifting allowance.

You can also make unlimited £250 gifts to anyone you’d like, though not to someone who has already benefited from your £3,000 exempt amount.

There’s also a gifting allowance for weddings and civil partnerships. You can gift up to £5,000 to a child, £2,500 to a grandchild, and £1,000 to any other person you know who’s getting married.

Again, if you’re married or in a civil partnership, the amounts effectively double.

2. Make potentially exempt transfers

On top of the gift exemptions above, you could make a gift of any size to an individual and have it fall outside the value of your estate, provided that you survive the gift by seven years or more.

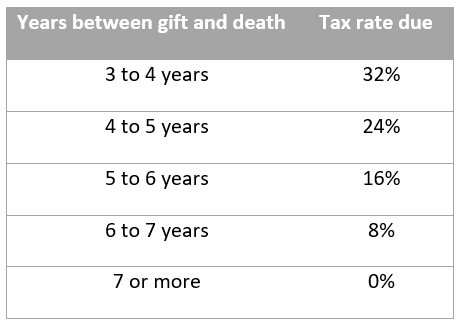

If you die within these seven years, the amount of IHT that may be due will depend on “taper relief” rules. The table below shows how the rate of IHT changes depending on how soon you die after making your gift:

Approached with care, gifting money could help you transfer your wealth to your chosen beneficiaries’ during your lifetime and help to reduce the size of your estate.

3. Set up trust funds

Trusts can be a useful estate planning tool to both protect your wealth and reduce an IHT bill.

When you put money or assets in trust, you essentially lock it away for an intended recipient – the “beneficiary”. You then appoint a “trustee” to oversee the trust, and will give the beneficiary access to the trust at a time of your choosing.

While trusts are useful for ringfencing wealth, they can also be tax-efficient. This is because IHT for wealth in certain types of trusts may be calculated in a different way to that of the rest of your estate.

Consequently, trusts can help with IHT and estate planning, while allowing you to retain a degree of control.

The tax rules around trusts can be complicated, so it’s often best to work with a planner if you’re considering this option.

4. Leave a charitable donation in your will

You can reduce the size of your estate and your rate of IHT by making charitable donations in your will.

Donate at least 10% of your total estate to charity, and the government will reduce your IHT rate to 36%.

Choosing this method allows you to support a good cause while also reducing your IHT bill.

5. Take income tax-efficiently in retirement

Another option you could consider is how you draw your income in retirement. For example, while investments and savings will count towards the value of your estate, your pension will not.

So, if you chose to live off your investments and savings while leaving your pension where it is, your family may be able to inherit your pension fund without having to pay an IHT bill.

If this is an option you think could work for you and your family, make sure you take financial advice as there may be other tax considerations you need to account for.

Get in touch

Our estate planning service helps to protect your assets for future generations in the way that you want – so that more of your money goes to the people who matter.

If you’d like to find a suitable strategy to reduce a potential IHT bill and protect your legacy, please get in touch.

Email contactme@kbafinancial.com or call us on 01942 889 883.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes, which cannot be foreseen.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Will writing is offered on a referral basis. The Openwork Partnership accept no responsibility for this aspect of our business. Wills are not regulated by the Financial Conduct Authority.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

For specialist tax advice, please refer to an accountant or tax specialist.

Approved by The Openwork Partnership on 02/09/2024.