If, like many retirees, you want to reduce risk and guarantee an income in retirement, you could consider buying an annuity.

An annuity is a type of insurance product that offers a regular, guaranteed income in retirement. Provided by insurance companies and some pension providers, you can purchase an annuity using either your pension or cash savings.

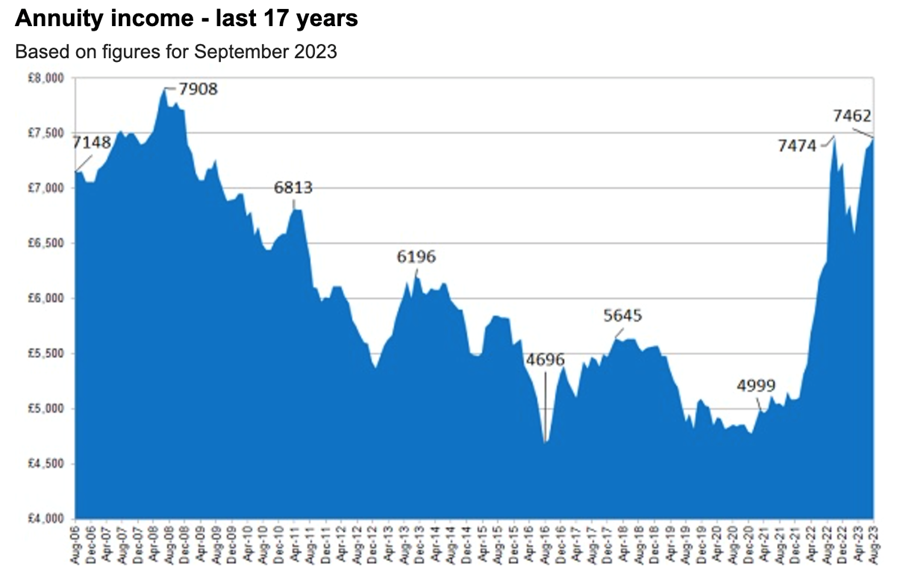

Annuity rates are at their highest level in two decades

Once a popular way to create an income from a defined contribution (DC) pension, annuities fell out of favour in 2015, when the government introduced Pension Freedoms legislation.

Now they’re growing in popularity again.

The key reason for this is that, thanks to rising interest rates, we’re starting to see annuities deliver significantly better payouts.

In fact, according to a report published in Money Marketing, it’s two decades since annuity rates were as high as they are today. As a result, interest in annuities has rocketed, with almost 50% growth since January 2022.

You can choose from multiple annuity options

Depending on the type of annuity you choose, the provider will pay you a fixed income for a pre-agreed length of time.

There are a variety of annuities, including:

- Lifetime annuity – provides a fixed income until your death and can be held individually or jointly. When you die, leftover funds can’t usually be transferred to your beneficiaries.

- Fixed-term annuity – pays a fixed income for a pre-agreed length of time. At the end of the period, you’ll receive a lump sum, or “maturity value”, from the provider.

- Guaranteed annuity – pays a guaranteed income for a set number of years, regardless of whether you die before the term ends.

While these are the main types of annuity, there are other options available. For example, some annuities will continue paying a reduced sum to your spouse after you die while others will increase in line with inflation each year.

Annuity rates are determined by several factors, including interest rates, life expectancy, and economic conditions.

Factors such as your age, health, and lifestyle will affect the annuity rate you’re offered. And a young, healthy person is likely to receive a lower annuity rate because the provider will expect to pay a regular income for longer.

Annuity rates fluctuate, but now may be a good time to lock-in a guaranteed retirement income

The chart below shows fluctuating rates over the last 17 years for a £100,000 annuity fund, based on a single life for a 65-year-old, with no guaranteed period.

In September 2023, such an annuity would pay an income of £7,462 a year. As you can see, the annuity income reached its lowest level of £4,696 a year in August 2016.

Source: Sharingpensions.co.uk

Benefits of choosing an annuity in retirement

With annuity rates at their highest level in years, now may be a good time to think about taking the option to secure a guaranteed income for the rest of your life. Here are some of the benefits of choosing an annuity in retirement.

Know how much income you have and for how long

The appeal of a known and stable income in uncertain times can’t be understated. Knowing how much income you are due, and when, could help make budgeting far simpler. If you expect to have known, fixed expenses in retirement, an annuity could be an ideal option for you.

Remove investment risk

Thanks to the guaranteed nature of annuity income, the money you have to live on in retirement will be less susceptible to market volatility.

Alternative ways to provide your retirement income, such as flexible drawdown, often means your pension savings remain invested. Buying an annuity means you remove the risk of your invested funds losing value.

Once you’ve purchased an annuity, the income you receive is not exposed to the same risk.

While having your retirement funds invested in your pension allows the potential for growth, it also exposes you to the risk of the value of your fund decreasing if markets perform poorly. A fall in the value of your pension savings and investments could jeopardise your retirement plans if your pension falls below the level you need to reach your later-life goals.

An annuity could help protect you from the effects of inflation

One important consideration for many retirees is the effects of inflation on their retirement income.

Of course, inflation has been particularly tricky since the Covid pandemic, but even when inflation is at more normal levels, you should expect to need a larger income in the future.

Remember, annuities aren’t all linked to inflation, but it is a useful option to consider. You can opt for an annuity that increases by a fixed rate each year, or one that is linked to increased inflation.

Bear in mind that an inflation-linked annuity may pay out a lower income when payments start, although payments will rise and provide protection against the effects of inflation in the future.

Potential downsides of buying an annuity

The idea of a guaranteed income in retirement is alluring, but before you commit, there are a few downsides to be aware of. For example:

- You can’t change your mind – once you’ve bought an annuity, you can’t typically reverse your decision. So, you’ll need to be 100% sure that this is the right option for you before you commit.

- There’s no guarantee you’ll live long enough to reap the rewards – if you buy a lifetime annuity, you’ll only receive income while you’re alive. As a result, you could end up receiving less from an annuity than the amount you paid it for.

- Invested pension funds could continue to rise in value – while purchasing an annuity removes the risk of your pension savings losing value and negatively affecting your retirement plans, you’ll also give up any potential returns that those funds might have generated. It’s important to decide which matters to you most: guaranteed income or potential growth.

Before deciding on an annuity, you’ll need to be clear about exactly what you wish to achieve. This will help you to select the most appropriate type of annuity for your needs.

With multiple options and a variety of factors influencing the amount of income you can guarantee through an annuity, if you’re considering buying an annuity, it’s wise to speak to a financial planner before you make a final decision.

Get in touch

If you’d like to discuss whether an annuity might be a good option for you, please get in touch.

Email contactme@kbafinancial.com or call us on 01942 889 883.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investments (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances. Levels, bases of and reliefs from taxation may change in subsequent Finance Acts.

Approved by The Openwork Partnership on 17/10/2023.