Between July 2021 and July 2022, HMRC collected £729 million in Inheritance Tax (IHT). The government’s final IHT bill for the 2021/22 financial year came in at a whopping £6.1 billion.

In more concerning news, the office for budget responsibility (OBR) has recently stated that they expect that the IHT bill could increase to £8.3 billion by 2026.

Being able to pass your wealth on to your loved ones is a dream for many people, yet it can be a challenging area to navigate. Talking about money is rarely easy, particularly when family is concerned and different emotions, values and expectations collide.

An estate plan can help you manage your IHT bill and make sure more of your money goes to your loved ones, instead of HMRC. Read on to find out more about steps you can take to protect your legacy and how we can help.

IHT rules – the numbers that matter

While IHT is due on everything you own when you die, the good news is that everyone has a tax-free amount. This is known as the “nil-rate band” (NRB).

In 2022/23 the NRB allows you to give away £325,000 tax-free if you are single or £650,000 if you are married.

You may also potentially be able to make use of the residence nil-rate-band (RNRB), giving you an additional £175,000 tax-free allowance if you pass your home to children or grandchildren.

Any value above the “nil-rate band” of £325,000 and the “residence nil-rate band” of £175,000 (assuming you’re leaving your main home to children or grandchildren) will be taxed at 40%.

This means that you may be able to pass on up to £500,000 of your money to your family without incurring a tax bill. If you’re married, this could be up to £1 million, as you can include your partner’s tax-free allowances.

Also, usefully, pension funds don’t usually form part of your estate for IHT.

How estate planning can help you mitigate IHT and leave the legacy you want

The right planning now can help ensure that your wealth is passed on to future generations, without being unnecessarily eroded by IHT charges. Here are five ways you can protect your wealth from IHT.

1. Write a will

It may sound obvious, but 59% of UK adults haven’t written a will. According to the 2020 study, from Canada Life, this equates to 31 million people.

If you haven’t written a will, your estate could be distributed in a way that goes against your wishes.

You can also use your will to help reduce IHT liability. For example, leaving your main home to your child or grandchild, will use the £175,000 RNRB mentioned above.

2. Make use of gifting allowances

Gifting some of your wealth while you’re still around is not only rewarding but can also be a helpful way to reduce your estate’s liability for IHT when you pass away.

Everyone has a personal gifting allowance that allows you to give money to anyone you like, without it being included in your estate. In the 2022/23 tax year, you can gift up to £3,000, or £6,000 as a couple, each tax year.

As well as the personal gifting allowance, the following gifts also fall immediately outside your estate:

- Up to £250 per person each tax year, as long as you haven’t used another exemption on the same transfer

- Wedding or civil ceremony gifts up to £1,000 per person, increasing to £2,500 for grandchildren and £5,000 for children and stepchildren

- Payments that help with another person’s living costs, such as an elderly relative or child.

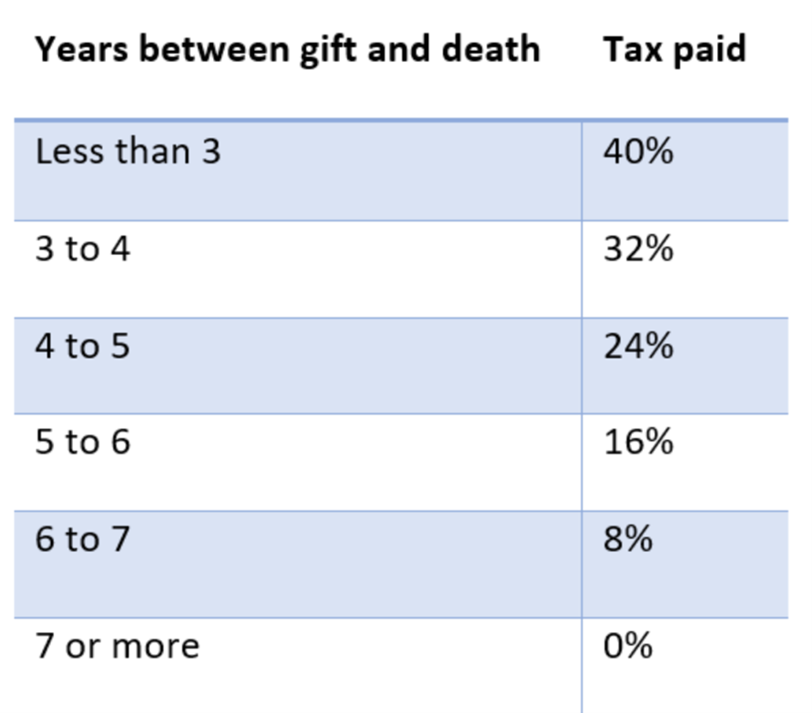

Potentially exempt transfers (PETs) can also be useful as they allow you to give unlimited amounts to anybody you like. Unlike the standard 40% IHT charge, PETs exist on a sliding scale, known as “taper relief”.

Should you decide to gift money, be sure to keep accurate records of what you gifted, when, and who you gave the money to. This will help ensure that your executors know not to include that money in the value of your estate.

3. Protect assets with a trust

Trusts can be an effective solution for protecting and preserving your assets. They can be particularly useful when:

- You want to pass money to children or grandchildren but think they are too young to spend it wisely

- You’d like the money to be used for a specific purpose, such as education, buying property or another milestone in life

- You want to cover the costs of your IHT bill using life insurance.

If you would like to understand if you and your relatives could benefit from one, get in touch. We’ll assess your circumstances and explain which type of trust might best suit your objectives.

4. Consider leaving a charitable donation

Leaving money to charity in your will can reduce your total IHT bill.

If you leave 10% of your total estate to charity, the government will reduce your IHT rate to 36%.

While this may not sound like much, it could mean an extra 4% of your wealth will go to your family instead of HMRC. Plus, you’ll also be supporting a cause close to your heart in the process.

If you decide to leave something to charity, you can leave a fixed amount of cash, an item, or whatever’s left after other gifts have been distributed.

5. Remember to review your estate plan

Once you have an estate plan in place, it’s crucial that you regularly review it to make sure it still reflects your wishes.

Life doesn’t stand still. And there’s a possibility that the plans you made may not last as long as they need to. Family members may separate or divorce and this could make it necessary to rethink how you distribute your wealth.

At least once a year, you should ask yourself if you are still happy with the terms of your will. And check that the people you have nominated as executors remain the right choice. For any trusts you’ve set up, make sure you’re still happy that the trustees are still able to fulfil their role.

Get in touch

Estate planning helps you know how much your estate is worth, and makes you aware of any potential IHT liability, and what this might mean for others when you pass away.

It’s also important to take a well-balanced approach to estate planning, so you don’t leave yourself short in your own lifetime.

Most of all, having an estate plan can give you the peace of mind you need to live life now, safe in the knowledge that your estate is protected for future generations.

If you’d like help navigating the rules so you can avoid potentially costly mistakes, please get in touch. Email contactme@kbafinancial.com or call us on 01942 889 883.

Please note: The content of this newsletter is offered only for general informational and educational purposes. It is not offered as, and does not constitute, financial advice.

The Financial Conduct Authority does not regulate estate planning, trusts, tax planning, or will writing.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.