For anyone worried about soaring energy bills, there was some good news as we headed into autumn.

Average household energy bills under the energy price cap had been due to rise to around £3,500 a year in October. This equates to an 80% rise on household energy bills. And, in 2023, they had been estimated to increase further, reaching as high as £6,500.

Fortunately, the Government’s Energy Price Guarantee will limit the price households pay for each unit of gas and electricity they use.

Initially, former prime minister Liz Truss had pledged to support UK households for two years. This has now been restricted to apply for just six months.

What is the government planning to do now?

When scaling back the plan, Jeremy Hunt (in his position as new chancellor) said: “Beyond next April, the prime minister and I have agreed it would not be responsible to continue exposing the public finances to unlimited volatility in international gas prices.

“So, I am announcing today a Treasury-led review into how we support energy bills beyond April next year. The review’s objective is to design a new approach that will cost the taxpayer significantly less than planned whilst ensuring enough support for those in need.”

If Rishi Sunak’s new government takes no further action, on 1 April 2023, your bills will likely revert to being determined by Ofgem’s price cap and wholesale energy prices.

According to Sky News, this will see the average household pay £4,347 a year for gas and electricity from April 2023, instead of the promised £2,500.

This support is in addition to the £400 energy bills discount already available to UK households.

But what is the energy price cap? How does it affect UK households? And what are the government doing to protect UK consumers from the effects of the current global energy crisis?

Read on to discover the key facts you’ll want to know about the energy price cap and ways you can prepare for any stark changes in energy prices.

The energy price cap was introduced to protect consumers from being ripped off

The price cap was introduced on 1 January 2019 by regulator Ofgem. The cap was designed to protect millions of UK consumers from potentially being ripped off by expensive variable energy tariffs.

The cap limits what you pay for each unit of gas and electricity that you use and sets a maximum daily standing charge (the fee you pay for having your home or business connected to the energy grid).

However, the current global energy crisis, resulting from a combination of the domino effect caused by the war in the Ukraine and pandemic-based disruptions in supply chains, has meant that the energy price cap has risen at an unprecedented rate.

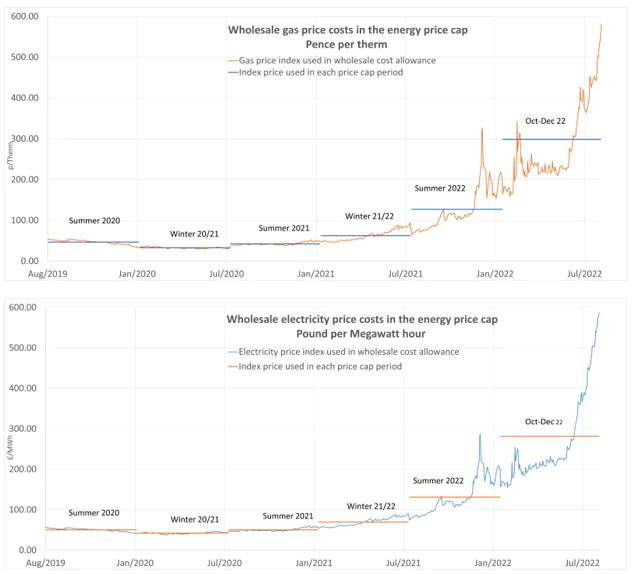

The wholesale prices for gas and electricity have shot up at an alarming rate over the past year.

Source: Ofgem

In turn, this has pushed Ofgem to raise the energy price cap accordingly.

According to Ofgem, the energy price cap was raised by 54% on 1 April 2022, putting added pressure on UK households.

It was due to rise again on 1 October 2022, as part of a bi-annual review, with Ofgem putting the latest increase at 80% or a cost of approximately £3,500 a year to the average UK household.

This has created a severe cost of living issue for millions of UK households that the former prime minister, Liz Truss, attempted to address with the government’s new energy bill.

The EPG is still dependent on your usage

The government’s EPG effectively froze the energy price cap at £2,500 a year for the average UK household for the next two years. As explained above, as a victim of the various government reversals and U-turns over recent weeks, this has now been amended to just six months.

The cap is based on the maximum energy suppliers are allowed to charge households for every unit of energy they use – represented as kilowatt hours (kWh) on your bills.

Under the EPG, a typical household is worked out as 12,000 kWh of gas and 2,900 kWh of electricity a year.

So, if you are part of a larger household, you may exceed the average and still end up paying more than £2,500 a year on energy bills. Conversely, if you use less and live in a smaller, more energy-efficient home then you are likely to pay less.

Under the current guarantee, between 1 October 2022 and 1 April 2023, people are paying a maximum of 34p per kWh for electricity and 10.3p per kWh for gas.

While the EPG will help with short-term costs, the effects of rising energy costs have, in effect, simply been delayed and it would be wise to continue to plan your finances around them.

The government also plans to support businesses and provide consumers with additional support

Businesses will be given a discount based on a “government supported price” of 21.1p per kWh for electricity and 7.5p per kWh for gas.

According to the government, this is less than half the wholesale prices expected this winter. Businesses on a variable tariff will receive an automatic discount for each unit of energy used with savings starting to appear on November’s bills (backdated to October).

In three months’ time, a review is expected to be published to identify “vulnerable” organisations, such as those in the hospitality sector, that may require support beyond March 2023.

As previously mentioned, all UK households will be given a one-off £400 discount on their energy bills from this October – this will be applied to energy bills through six instalments to help families through the coldest winter months.

This is in addition to £650 that will be paid to more than 8 million low-income households who are exceptionally vulnerable and receive benefits. Further payments of £300 to pensioners and £150 to those on disability benefits will also be sent out.

Protect your finances by setting aside an emergency fund

It is always wise to be prepared for a rainy day. Rising energy costs could put unexpected additional strain on your monthly outgoings at any point in the near future, so ensuring you have cash savings built up to draw from in an emergency is key.

You’re likely to need at least three months’ cash savings set aside to cover key bills such as rent, utilities, and household groceries.

If you have any surplus cash beyond that, there is no better time than now to get that money working for you to generate growth, whether it be in an ISA with particularly good interest rates or by investing in the stock market.

Get in touch

If you’re concerned about the rising cost of living and how this might affect your current and long-term financial plan, please get in touch. Email contactme@kbafinancial.com or call us on 01942 889 883.

Please note: Content accurate as of 25 October 2022.

The content of this newsletter is offered only for general informational and educational purposes. It is not offered as, and does not constitute, financial advice.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.