You’ll likely spend many years working to build your career and grow a nest egg to help you afford a comfortable retirement.

As your retirement draws closer, it’s natural to start thinking about what your financial future might look like. Little surprise then that one question people regularly ask is: “Will I have enough money?”

One of the most important – and rewarding – aspects of the work we do is to help you answer this question and create a financial plan for the retirement you desire.

First you need to know what you want from life

Before looking at your finances – your budget, pension, or investments – you need to know what you’re aiming to achieve.

Retirement goals and objectives are different for everyone. Knowing how you want to spend your time when you’re no longer working every day can help you understand how much money you might need to fund your desired lifestyle.

A life of travel, cruises, and golf will require a very different budget to time spent at home tending your garden or staying close to family and helping to raise your grandchildren.

Having a firm understanding of how you’d like your life to look will help you work out how much money you need.

To help you realise what you truly want, we’ll discuss your future hopes and dreams. Whether you plan to travel the world or focus on hobbies and loved ones closer to home, we’ll help you get your goals in place.

Working out how long your retirement pot may need to last

According to the Office for National Statistics (ONS), today a 65-year-old man has an average life expectancy of 85. Meanwhile, the average life expectancy for a 65-year-old woman is 87.

There’s also a 1 in 4 chance that women could reach age 94 and that men could reach age 92.

As a result, if you retire at age 55, your retirement savings may well need to last for 40 years – or perhaps more.

This is why it’s crucial to factor life expectancy into your calculations when thinking about funding your retirement.

As part of this, it’s useful to realise that your income needs may alter as you progress through life. Your retirement is likely to divide into three different stages:

- Active and busy – here, your spending may be highest as you tick items off your “bucket list” while you’re still relatively young and healthy.

- Settling in to enjoying your retirement – as you start to slow down, your spending will likely decrease as you travel and socialise less. Pottering in the garden and spending time with family will usually mean you see a reduction in your expenses.

- Later life – expenditure on care or medical bills may rise. You might need to undergo medical procedures or recuperate after surgery. You could also find that you’re more susceptible to illness and require some level of care.

We can use financial forecasting tools to help you plan for every eventuality, offering reassurance that you should have enough money to last your lifetime – or helping you to make appropriate adjustments, where needed.

Useful insight into how much you might spend in retirement

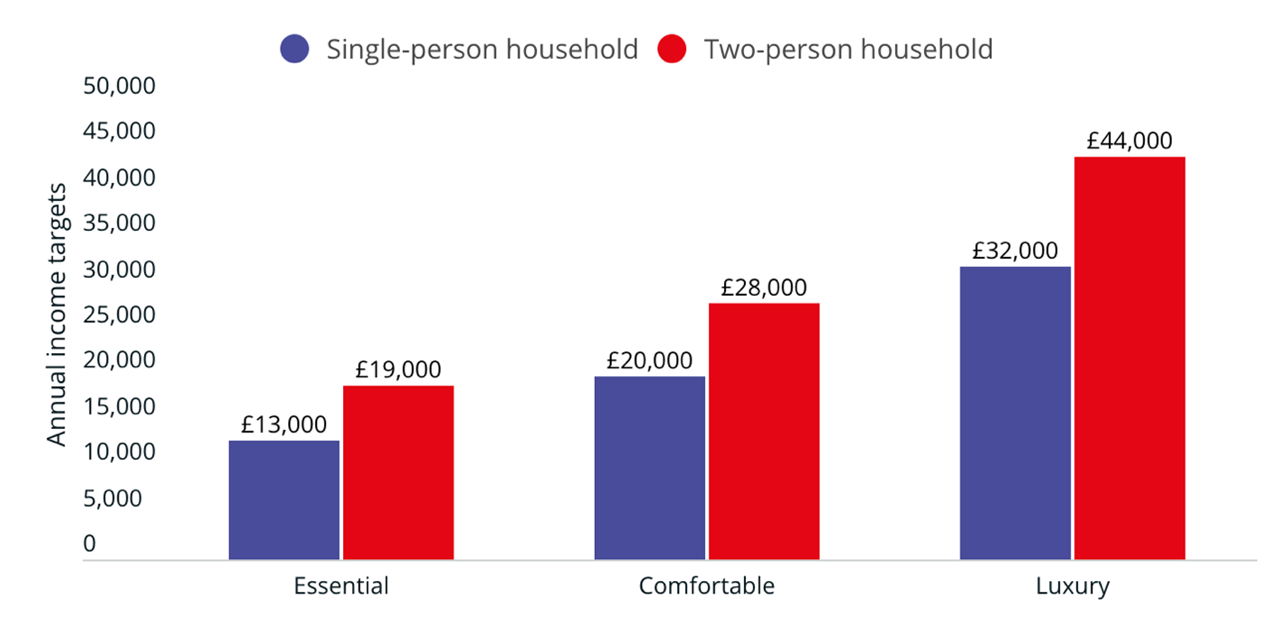

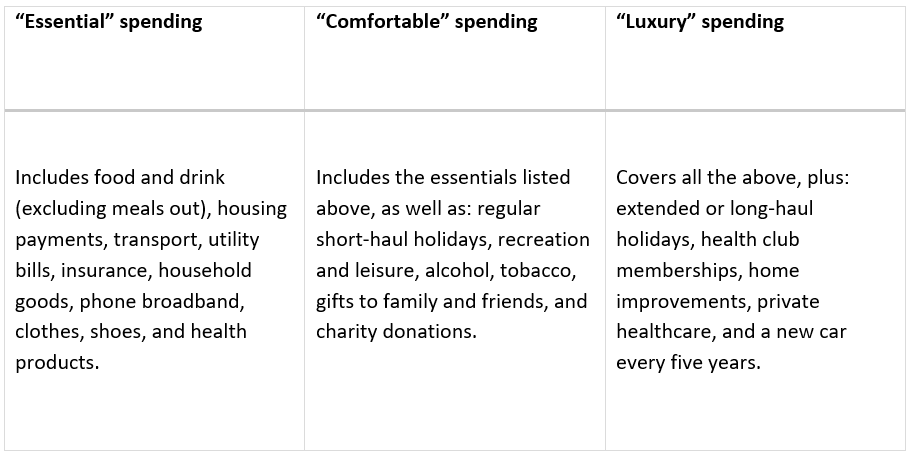

To give you an idea of how much you might need to aim for, Which? carry out an annual survey to find out how much British retirees spend in retirement.

The chart below illustrates how much you may be expected to need according to the lifestyle you hope to lead.

Source: Which?

How much do I need in my pension pot?

According to calculations from Which?, a couple wishing to enjoy a comfortable lifestyle with £28,000 a year income would need a retirement savings pot of:

- £115,000 if you opt for drawdown

- £131,000 if you opt for an annuity.

Drawdown figures here are based on a saver withdrawing all their money over 20 years from age 65, and assume investment growth at 3%, inflation at 1%, and charges of 0.75%.

Get in touch

Whether your retirement date is near, or many years away, it’s never too soon to put a plan in place.

We can help you take control of your future and create a financial plan to structure a tax-efficient income in retirement. To find out more about how we can help you, please get in touch.

Email contactme@kbafinancial.com or call us on 01942 889 883.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

Past performance is not a guide to future performance and should not be relied upon.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

Approved by The Openwork Partnership on 6 June 2023.