One in three investors are planning to give their adult children a living inheritance during 2022. Although the typical gift size is between £10,000 and £20,000, research from interactive investor suggests that one in five of these investors expect to give £50,000 or more.

The anticipated “great wealth transfer” follows months of pandemic-related savings, particularly among older, wealthier households. Meanwhile, rising house prices have increased the value of property assets held by older people and made it even harder for younger people to get onto the ladder.

These simultaneous events have created the perfect rationale for older investors to offer financial assistance to their adult children.

As well as house deposits, there are other reasons to gift to adult children.

Previous research, again from interactive investor, found that:

- 28% of parents gifted money into a savings account for their adult children

- 23% paid into an ISA

- 10% made a long-term gift with a pension contribution.

The growing trend to give financial help to grown-up children could be due to the additional tax benefits to “giving while living” for those whose estate could be liable for Inheritance Tax (IHT).

Along with the potential tax efficiencies, more investors are also finding that it’s better to give at a time when the financial boost is most useful to their children, rather than on death.

3 top tips for giving living inheritances

One of the best things about making lifetime gifts is that you’ll get to see your children benefiting from the money, often at a time when they need it most. However, before you get carried away with the idea, here are three things to consider.

Find out what amount would be helpful

Before you start selling your assets, talk to your children to find out what amount would be helpful and why. You may find that there are other, non-financial ways you could help, such as offering adult children the option of living at the family home rent-free for a time. Alternatively, you may find that you can help reduce their monthly outgoings by providing regular free childcare during the week.

Understand the 7-year rule

By making early inheritance gifts seven or more years before your death, gift recipients won’t have to pay IHT.

Those you give gifts to will only be charged IHT if you give away more than £325,000 in the seven years before your death. Anything over £325,000 will be taxed retrospectively.

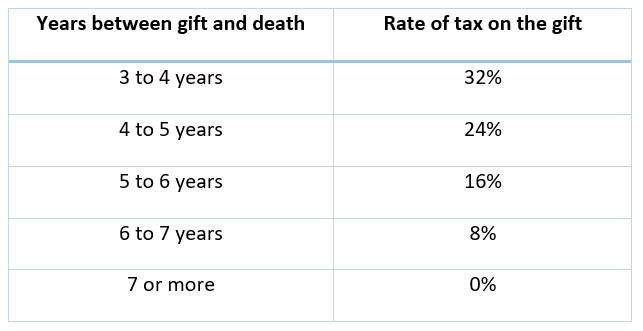

Gifts given between three and seven years before death are taxed on a sliding scale. This is called “taper relief”.

This table shows how taper relief works:

Make sure you can afford to gift the money

Make sure you can comfortably afford to gift the money before you offer it. Consider what would happen if you had a significant health knock-back, or if there was a stock market downturn.

Some people avoid gifting money during their life because they fear they might need it themselves. We can help ensure that you won’t compromise your own situation with cashflow modelling.

This allows you to establish how much money you need to fund your own future, what to save in your emergency fund, and how much you can comfortably afford to gift to your family.

Get in touch

If you want to give a living inheritance to your adult kids, talk to your financial planner first to make sure whatever you give won’t derail your own financial goals.

Get in touch and we’ll help you understand how much you can comfortably afford to gift. Email contactme@kbafinancial.com or call us on 01942 889 883.

Tax Advice is not regulated by the Financial Conduct Authority.