Many investors use Stocks and Shares ISAs as a core part of their investment portfolios, and it’s likely that they form an integral part of your financial plan.

Because ISAs (Individual Savings Allowance) are free of Income Tax and Capital Gains Tax (CGT), they can be a great way to invest for your long-term future.

6 April 2023 marked the start of the new tax year, and you can invest up to £20,000 in your ISA before 5 April next year.

While many investors end up rushing to make their ISA investment as the tax year draws to a close, the savvy often invest early to maximise the opportunity for growth. Although investing regularly throughout the year could also be worth considering.

Investing in an ISA early in the tax year can provide an extra year of tax-efficient growth

Research from a leading investment platform supports the theory that you could be better off investing into an ISA at the beginning of the tax year.

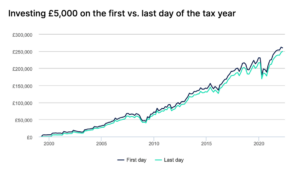

The research looked at the returns of two separate £5,000 investments each tax year, from the date ISAs were first launched in April 1999.

Each investor invested a total of £115,000 over the entire period. But one invested on the first working day of the tax year, the other on the last working day.

Even faced with several difficult times during the 23 years, including the dot-com crash, the war in Iraq, the 2008 financial crisis, and, more recently, the Covid crisis, both methods fared well – with each returning more than 115% growth, excluding charges.

However, had you invested at the start of each tax year, you would have ended up more than £10,000 better off than the investor who put their money in an ISA at the end of the tax year.

Source: HL. Includes 2021/22 subscriptions for both.

Of course, this isn’t guaranteed to always be the case and past performance isn’t a guide to the future.

However, this does show that if you’re organised and make your ISA investment early in the tax year, in the long term, you could be better off than someone who leaves it to the last minute.

Alternatively, you could benefit by investing regularly throughout the tax year

Even if you have enough cash to invest the full £20,000 into an ISA at the start of the tax year, you may find investing regularly more appealing.

Markets can suffer from volatility and investors have experienced some tricky periods recently. Investing smaller amounts monthly can help reduce some of the emotional barriers that may give you pause for thought.

Drip-feeding your money into the stock market means that you’ll end up buying shares at a range of different prices. When prices rise, your money will buy fewer shares. But, when prices drop, your money will go further and buy you more stock.

This is called “pound-cost averaging” and can help to reduce the effects of volatile markets because, over time, you end up buying the average market price.

Should the market experience a rough period, regular investing can help cushion the impact.

While there’s no guarantee of achieving better returns than you’d get from investing a lump sum, over a fixed, long-term period, you will end up paying the average price of the share. This can help to reduce your risk and, potentially, provide you with smoother returns.

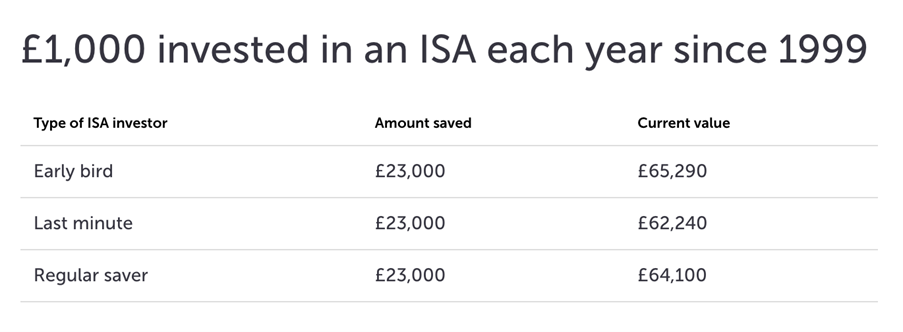

Another investment platform leader revealed the different returns for £1,000 ISA investments made every year from 1999 until 2022, comparing early bird investors with those who waited until the last minute, and saving regularly throughout the year.

Source: AJ Bell. Total return of IA Global Sector Average in GBP to 16th March 2022.

As you can see, the early bird investor ended up £3,050 better off than the last minute investor. Meanwhile, the regular saver ended up £1,860 better off than the investor who left things until the last minute.

Get in touch

If you want to make the most of your ISA allowance, we can help. Email contactme@kbafinancial.com or call us on 01942 889 883.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

An ISA is a medium- to long-term investment, which aims to increase the value of the money you invest for growth or income or both. The value of your investments and any income from them can fall as well as rise. You may not get back the amount you invested.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

Past performance is not a guide to future performance and should not be relied upon.

The Financial Conduct Authority does not regulate tax planning.

The content of this summary is intended for general information purposes only. The content should not be relied upon in its entirety and shall not be deemed to be or constitute advice.

While we believe this interpretation to be correct, it cannot be guaranteed, and we cannot accept any responsibility for any action taken or refrained from being taken as a result of the information contained within this summary. Please obtain professional advice before entering into or altering any new arrangement.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

Approved by The Openwork Partnership on 5 April 2023.