During the mini-Budget in September, former chancellor Kwasi Kwarteng announced changes to the Stamp Duty threshold in England and Northern Ireland. If you’re planning to buy property, it could save you thousands of pounds.

While the government has since backtracked on many of the announcements made during the mini-Budget, the new threshold for Stamp Duty is one of the few to remain. It’s hoped that the change will encourage property sales despite rising interest rates and economic uncertainty.

If you’re buying property in Wales or Scotland, you should be aware that taxes and thresholds when buying property are different. In Wales, you may need to pay Land Transaction Tax when buying property, while in Scotland you may be liable for Land and Buildings Transaction Tax.

What is Stamp Duty?

Stamp Duty is a tax you pay when you buy land or property.

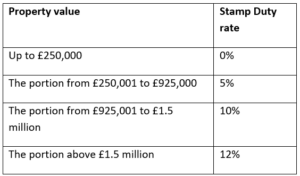

The Stamp Duty tax system is progressive. This means that rather than paying a single rate of tax on the entire property, you may pay different rates on certain proportions of the value. So, understanding the thresholds is important for calculating your potential tax bill.

According to HMRC statistics, the government collected £18.6 billion in Stamp Duty during the 2021/22 tax year.

You must pay Stamp Duty within 14 days of completion in England and Northern Ireland. So, it should be part of your expected expenses when you buy a home.

The threshold for paying Stamp Duty doubled in September

Previously, the threshold for paying Stamp Duty was just £125,000.

Rising property prices mean that most homebuyers would be liable for the tax. According to the Halifax House Price Index, the average house price in September 2022 was more than £290,000 following an annual increase of 9.9%.

From 23 September 2022, the Stamp Duty threshold increased to £250,000. So, fewer homebuyers will be liable for Stamp Duty, and those that are buying a property exceeding £250,000 will benefit from a lower bill.

The new tax bands for Stamp Duty are:

So, if you are purchasing a home for £300,000 your Stamp Duty bill would be £2,500. This would be because:

- You’d pay no Stamp Duty on the first £250,000

- The remaining £50,000 would be liable for Stamp Duty at a rate of 5%.

The government’s Stamp Duty calculator can help you understand how much your tax bill will be when buying property.

If you’re buying a property that won’t be your main home, such as a buy-to-let property, holiday let, or a second home, there is a Stamp Duty surcharge of 3%.

The Stamp Duty threshold for first-time buyers is higher at £425,000

The first-time buyers’ relief has also increased. If you’re hoping to buy your first home, the value can be up to £425,000 before Stamp Duty is due, up from the previous threshold of £300,000.

The total value of the property you can purchase while remaining eligible for the relief has also increased to £625,000.

It means that most first-time buyers won’t need to factor Stamp Duty into their budget and those that are purchasing a home exceeding the threshold could save money.

We can help you understand your expenses when buying a home

When you’re purchasing a property, whether it’s your first home or as an investment, it’s important to understand the expense and long-term financial commitment. We can help you get to grips with this, including how much Stamp Duty you could be liable for and understanding mortgage repayments.

If you’d like to talk to us, please get in touch.